The Kangaroo’s jump

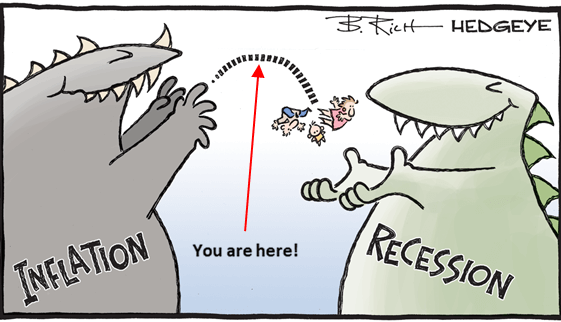

The latest US employment report put a dent in the Fed’s pivot narrative with somewhat higher than expected nonfarm payrolls (+199k, in line with the last 6 months average) and, more importantly, a lower unemployment rate (-0.2% to 3.7% in November). Indeed, this decline in unemployment rate invalidated, at least theoretically, a recession signal from […]