DECALIA SIM SpA provides portfolio management advisory services to private and institutional clients. In addition, thanks to its asset management team, it manages and distributes high-added-value investment funds.

DECALIA SIM offers a modern asset management that truly lives up to investors’ new expectations. Through its distinctive approach, DECALIA focuses on a clear objective: securing a first-rate performance, based above all on consistent results and stringent risk control. DECALIA benefits from the solid experience of its team of professionals and on some strong fundamental principles that guide its decisions.

DECALIA SIM SpA is regulated by Consob and by the Bank of Italy.

Wealth Management

Private management

DECALIA targets a private clientele looking for personalised wealth management that generates consistent performance.

Based on the advanced techniques and rigorous processes of institutional asset management, our investment approach is clearly focused on risk control.

A human-sized management boutique, DECALIA naturally pays particular attention to the quality of service.

Asset Management

Asset Management

DECALIA has developed a range of strategies focused on several investment themes offering strong long-term prospects.

DECALIA has launched its own range of UCITS investment funds (DECALIA Sicav), registered in Switzerland and other European countries. For some specific strategies, we have also established partnerships with external asset managers.

Team

DECALIA team

DECALIA’s asset management team is made up of seasoned investment professionals, whose areas of expertise are very complementary.

NEWS

Recent news

The Kangaroo’s jump

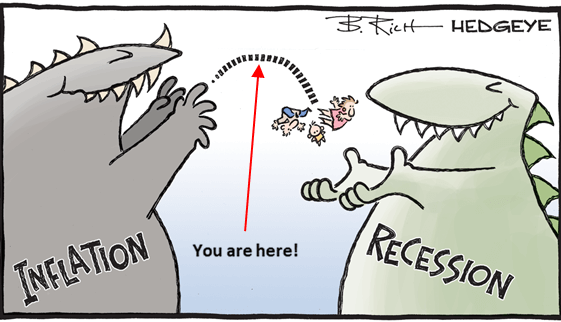

The latest US employment report put a dent in the Fed’s pivot narrative with somewhat higher than expected nonfarm payrolls (+199k, in line with the last 6 months average) and, more importantly, a lower unemployment rate (-0.2% to 3.7% in November). Indeed, this decline in unemployment rate invalidated, at least theoretically, a recession signal from […]

DECALIA in Private Debt Investor

For their latest cover story on the outlook for private credit, Private Debt Investor talked to “some of the asset class’s most prominent supporters”. Reji Vettasseri from DECALIA Private Markets was one of them and gives his views.

Beware of the Grinch

Latest US data and some Fed members statements reinforced the current optimistic views made of resilient growth and ongoing disinflation. Consumers income and spending are indeed still expanding, manufacturing activity is holding well according to latest ISM, while the Fed’s favorite inflation gauge, the PCE deflator, decelerated further in October. The headline reading was actually […]